Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

(Bloomberg)-US Treasury bonds adhere to the recent gains before the interest in the federal reserve, as traders have made bulls in the hope that President Jerome Powell indicates a discount in March at the table.

Most of them read from Bloomberg

The revenues did not change a little through the curve on Wednesday, as rates hovering for two years at the lowest level in more than a month, as the market waited for the press conference on the afternoon of Powell to obtain evidence about expectations of politics. It is expected that the US Central Bank will maintain a largely -up prices this week, although the premiums are almost 30 % pricing in March.

Traders have a lot of Powell’s comments. Expectations rose to further mitigate this week during a technology -based defeat in stocks and the fascinating atmosphere produced a wave of bets on treasury gains. It shows the latest survey of the customer at JPMorgan Chase & Co. On Tuesday, the biggest long position in the debts of the US government for nearly 15 years.

“The Federal Reserve showed equal bias,” said Kevin Those, a member of the Carmagnak Investment Committee, who prefers the treasury over European kings. “It was the latest inflation’s latest benign, not to mention the potential contraction of the latest developments in artificial intelligence.”

It makes sense to hedge the price of the possible march after the most cold inflation in December is suspended from the suspension and file of the inflation governor, which is possible to mitigate by the middle of the year. Of course, the big question mark remains the tariff plans for President Donald Trump and its impact on the economy.

Looking at the lack of clarity about the fees, “Powell may see Powell hesitating to hold a meeting in a march, Edward Acton at Citigram said that the strategy of” Citigram “, although it seems a stable job market. Note.

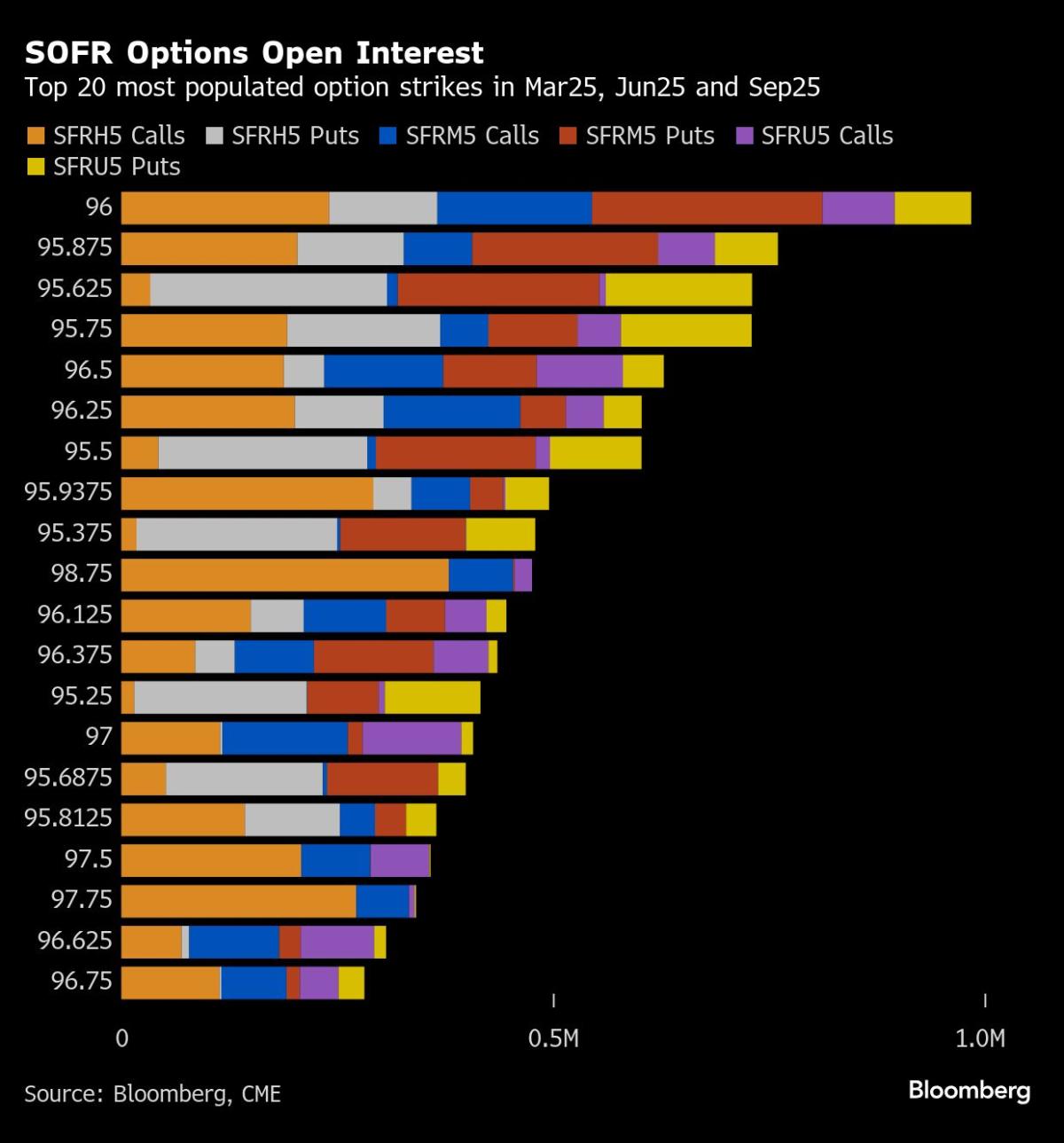

In another sign that long positions are built in treasury bonds, the open interest in future contracts-or the amount of new risks kept by traders-is increasing in 10-year notes contracts, especially after the bonds gathered on Monday. In options, prominent trade in modern sessions also targeted a larger gathering in bonds. The profits in this position got a batch of Monday’s increase in the assets of Haven.

Morgan Stanley believes that Wednesday’s meeting is a catalyst for another less leg in treasury revenue, with strategists led by Matthew Horpillan, they recommend investors who have been staying for a long time in 5 years and a position to cut March.